Cazenove capital share their views on how will the budget impact high net worth individuals and businesses going forward.

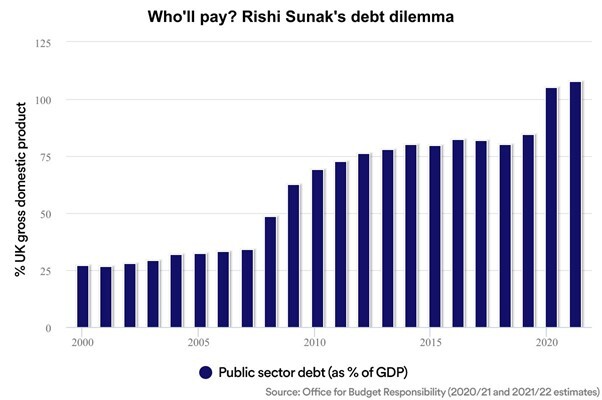

The 2021 Budget comes at an extraordinary moment in the nation’s financial history, as Chancellor Rishi Sunak explained, following “one of the largest and most sustained economic shocks this country has ever faced”. The pandemic has pushed borrowing up to a record sum and— for the first time in 60 years — UK public debt is estimated at more than 100% of the country’s annual economic output or GDP.

This debt must be reined in, he said, and while the vaccine roll-out gives hope for a strong economic rebound, he signalled that tax increases would play a part in his debt reduction strategy.

“We need to begin the work of fixing our public finances”

The Budget comprised two parts. There was a package of further stimulus and support for households and businesses, tilted to particular sectors (scroll down for more detail). Then – under the heading “Strengthening the public finances” – came a two-pronged tax policy.

Corporate taxes will rise from 2023, with the new 25% rate being applicable to all closely held investment companies (FICs) irrespective of size.

As a way of increasing the tax take from individuals, personal allowances and thresholds will be frozen for five years until 2026. This meets the Conservatives’ manifesto pledge not to raise taxes, but effectively allows the tax take to swell on the back of rising wages and investment returns.

Personal tax allowances and thresholds frozen – in detail

Mr Sunak has said that from this April he will freeze the current thresholds at which basic (20%) and higher (40% and 45%) rates of income tax apply. Acknowledging that this will “remove the incremental benefits” over the years ahead, he said the policy was “progressive and fair”.

This will capture an estimated extra £19 billion by the end of 2025-26.

The annual capital gains tax allowance, the inheritance tax allowances and the pension lifetime allowance – the limit on what can be paid into a pension and qualify for tax relief – will also be frozen until 2026. ISA allowances will remain unchanged for 2021-2022.

Capital gains and inheritance tax: on guard for 23 March and beyond

What of the predicted increases in capital taxes? Mr Sunak said little. In particular capital gains tax, expected to be within his sights following a review he commissioned in July 2020, was not mentioned. We anticipate further information on 23 March – dubbed “Tax Day” – when the Treasury will publish a number of tax policy consultations. These are expected to incorporate potential changes to the capital gains tax regime, which could include:

• Raising the rate of capital gains tax, which is currently well below income tax rates for most assets

• Reducing or removing Business Asset Disposal Relief (“Entrepreneurs’ Relief”), which currently limits tax due when business holdings are sold

• Allowing uncrystallised gains to remain in force after the asset owner dies and bequeaths the asset to a child or other beneficiary – effectively an increase in estate duties

Tax planning: do you need to act?

Our view remains that the current tax regime, particularly in relation to capital gains, is comparatively generous by historic standards. Although the Chancellor has for now held back, we think this remains an area of likely future reform.

If you have not already done so, it is worth reassessing existing planning arrangements. In some cases it may be worth bringing forward disposals in order to benefit from the current gains tax rates. Strong recent performance in many asset classes could be another reason to review gains and possible disposals.

Selling shares or funds for planning purposes does not need to involve any change to your long-term investment strategy.

________________________________________

Budget 2021: business and the economy

Business investment a key theme

"Business investment is a key theme of the Budget, with tax relief benefits of £25 billion over the next two years designed to 'spur investment'. We are particularly excited about the benefits of this relief to UK software companies and SMEs. For example, the government is expected to cover half the costs of approved software up to £5,000 which should benefit our learning technology and artificial intelligence companies.

"Confirmation was given that the furlough scheme will be extended to September 2021, although businesses will be asked to make contributions of 10% in July and 20% in August as the scheme is phased out. Many consumer companies can now see the light at the end of the tunnel and we expect pent-up demand to come through.

"While the overall effects of the budget are positive, we should of course recognise that British companies have faced unprecedented difficulties over the last year. Increased activity in the IPO market and companies coming to market for equity capital is a sign of confidence about the future growth prospects ahead."

Rory Bateman, Head of Equities, Schroders

Fiscal consolidation to come later

"An ambitious Chancellor set out his plans not just for the near term recovery, but also to meet the Government’s promises of levelling up the economic geography of the UK and to repair the public finances over the medium term. It was a budget to take us through the pandemic and beyond.

"The fiscal consolidation comes later and is led by a rise in corporation tax from 19% to 25% – a significant move and almost identical to the 26% proposed by the then hard left Labour party which lost the last general election. Alongside this, the Chancellor is planning to freeze all tax brackets for households. Penned in by his party’s promise not to raise taxes in the election manifesto, Chancellor Sunak is relying on that favourite stealth tax, fiscal drag.

"So fiscal consolidation is coming, but the can has been kicked down the road. In the meantime along with the covid relief measures, the Chancellor is throwing as many goodies at business as possible: he also announced enhanced tax allowances (“super deductions”) along with subsidised training and software for firms."

Keith Wade, Chief Economist, Schroders

Statements concerning taxation are based on our understanding of the taxation law in force at the time of publication. The levels and bases of, and reliefs from, taxation may change. You should obtain professional advice on taxation where appropriate before proceeding with any investment.

Cazenove Capital:

This article is issued in the UK by Cazenove Capital which is part of the Schroders Group and is a trading name of Schroder & Co. Limited, 1 London Wall Place, London, EC2Y 5AU. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Issued in the Channel Islands by Cazenove Capital which is part of the Schroder Group and is a trading name of Schroders (C.I.) Limited, licensed and regulated by the Guernsey Financial Services Commission for banking and investment business. Nothing in this document should be deemed to constitute the provision of financial, investment or other professional advice in any way. Past performance is not a guide to future performance. The value of an investment and the income from it may go down as well as up and investors may not get back the amount originally invested. This document may include forward-looking statements that are based upon our current opinions, expectations and projections. Exchange rate changes may cause the value of any overseas investments to rise or fall. We undertake no obligation to update or revise any forward-looking statements. Actual results could differ materially from those anticipated in the forward-looking statements. All data contained within this document is sourced from Cazenove Capital unless otherwise stated. For your security communications may be recorded and monitored.

From real-time dashboards to cost-saving automation - structured internship programmes deliver commercial results. Here's how to make them work.

Young entrepreneurs will be supported to turn their ideas into successful businesses through a new Scottish Government programme.

An internship through the Saltire Scholars Programme helped Donaldson Group create Spec3D, a new 3D visualisation business now used by house builders across the UK.